Scenarios – When Would You Need My Se rvices

rvices

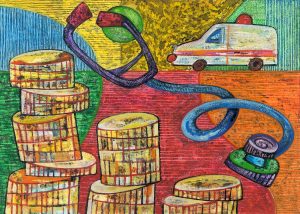

Medical Bill Review and Advocacy

You may be uninsured, and be faced with a daunting Emergency Room or hospital bill. You may be insured, but your insurance company has denied paying for charges. We can help negotiate bills, file appeals, and check bills for accuracy. This service is for people of all ages, and in all states. Hospital bills can be sent to collections, impacting your credit rating very quickly. Moreover, regardless of whether you have health insurance or not, whatever medical bills you incur are ultimately your financial responsibility. My initial evaluation of your situation is free. When at all possible, I charge a flat fee, so you know my charges upfront. Additionally, I can leverage the expertise of my colleagues. Member advocate companies include physicians, nurses, and medical billing professionals. Together, we can solve your problems.

Case Studies include:

Client’s father was recently deceased. Client was receiving thousands of dollars of bills posthumously, that should have been covered by Medicare and/or the Medicare Supplement in place. We were able to sort out which bills needed an appeal, which had been billed erroneously, and which co-payments really were owed by the estate.

Savings was approximately $12,000.

Client was insured, but responsible for a large deductible and co-pay. When going over hospital bill, many billed items were erroneous. Savings of several thousand dollars.

Client was insured, but many items on billing were denied. Appeals required special documentation, and were resubmitted. Subsequently approved.

Insurance Advocacy

As a licensed life and health insurance agent and a Licensed Insurance Advisor, I am familiar with policy language and procedures. I know what will be approved, and what will probably be denied. I can file claims for long term care insurance, life insurance, and health policies. I can review existing life insurance policies for cash value, and arrange for policy purchase if settlement would result in more money to the client. I can help get you the benefits you have been paying for.

Case Studies

92 year old client was debilitated, and unsafe in home after suffering a mild heart attack. He had a long term care insurance policy from a less than stellar insurer (notorious, and under state investigation, for denying claims). We took the 3 page claim form, and with supporting documentation, submitted a 50 page claim to the insurer for benefits for client to go to assisted living facility. Claim was approved on the first try, and with our help submitting recurring monthly claims, client was able to access all the monies available under the policy.

Client had recently become responsible for affairs of her elderly mother, who seemed to have a number of life insurance policies, and what may have been a long term care policy, and hospital indemnity policy, both through the retirement benefit from her former employer. We came in and explained all policies, what benefits would be available, when policies would trigger, and were able to cash out some life policies, and settle others. This enabled client to plan for what resources would be available for her mother’s care, when it was needed.

Insurance Services

Medicare Supplement and Medicare Advantage Plans (Part C)

Clients can sign up for Medicare Supplement plans at any time during the year. Medicare Supplement Plans pay for the co-insurance and deductible portions of Medicare. In Massachusetts, there are only two Supplement plans, and they are guaranteed issue (no underwriting – everyone accepted). They cost less than $200/month.

In other states, there are up to 10 different Supplement Plans. If you are not “aging in” (turning 65), you must be medically underwritten. Moreover, the premiums go up as you age.

Medicare Advantage plans (Medicare Part C) are available as an enhancement to Medicare for those who do not want to buy a Medicare Supplement, are too sick to qualify, or can not afford a Medicare Supplement. Although most plans can only be signed up for during Open Enrollment, there are certain situations where enrollment in Medicare Advantage is available all year: a) clients who enter a nursing home b) clients who are dropped from their employer retirement health insurance plan c) clients who have certain chronic conditions or are certified “low income” d) clients who move into or out of their current service area. e) clients who are “aging in.” Plans start at a $0 premium, and have a small co-pay for services instead of large deductibles and co-insurance of Original Medicare alone. Most plans cover Part D (Prescription).

Hospital Indemnity Plans help to pay the larger hospitalization co-pays for regular health insurance and Medicare Advantage plans

Critical Illness Insurance pays a lump sum if the insured suffers a catastrophic illness like cancer, stroke, heart attack, etc. Cheaper and easier to qualify for than disability insurance, critical illness insurance can help pay bills that health insurance doesn’t pay when you get sick.

Life Insurance and Annuities

Life insurance and annuities with a Long Term Care (or Living Benefit) rider preserves and builds cash, while guaranteeing face value of policy if long term benefit ever needed. As of January 1, 2011, these policies, with the LTC rider (also called hybrid policies), pay out for Long Term Care tax free if the LTC benefits are needed.

FREE REFERRAL TO OTHER SENIOR RESOURCES